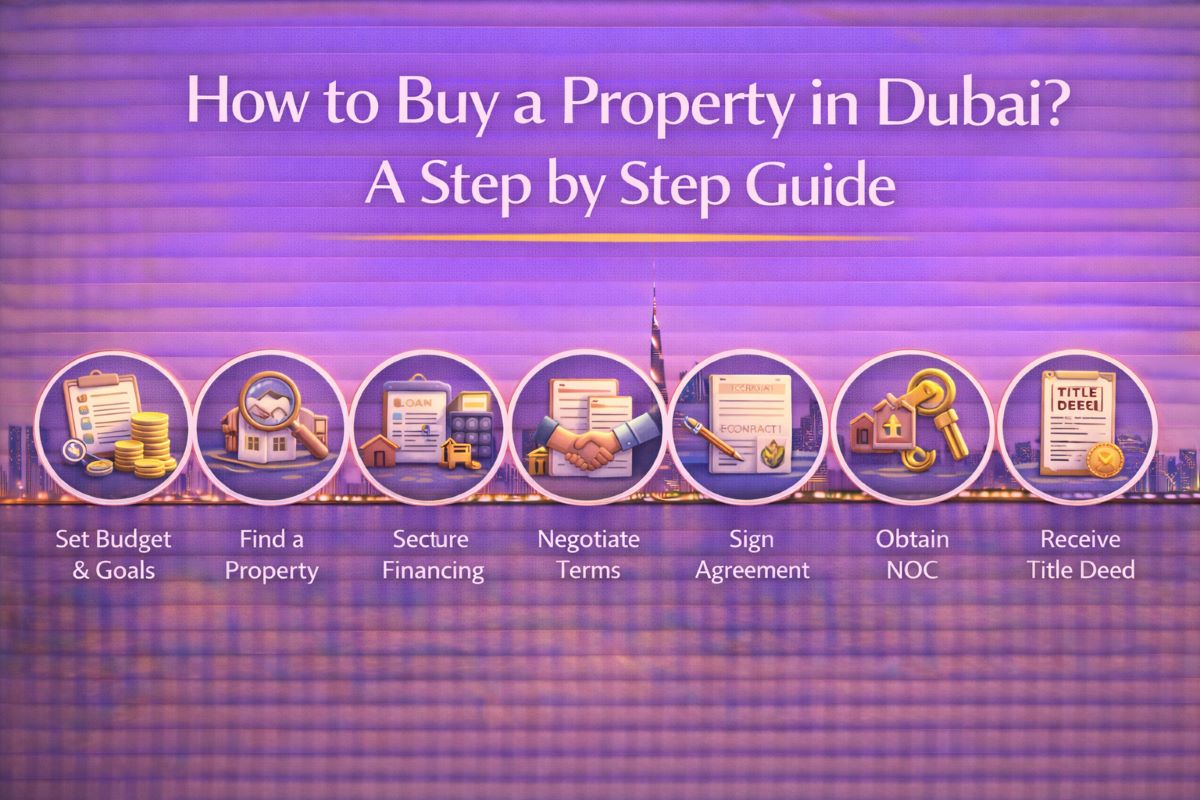

How to Buy a Property in Dubai? A Step by Step Guide

Buying property in Dubai has become a well-structured and accessible process for both local and foreign buyers. Whether the goal is investment, rental income, capital appreciation, or lifestyle relocation, Dubai offers a transparent legal framework, strong market demand, and a wide range of property options. However, success depends on understanding each step clearly and avoiding rushed decisions.

This step by step guide to buying property in Dubai is designed to match real search intent: practical, detailed, and action-oriented. It explains how the process works from the first planning stage to ownership, rental strategy, and long-term planning, with a strong focus on clarity and realistic expectations.

Understanding property ownership rules when buying property in Dubai

Before buying property in Dubai, it is essential to understand how ownership works, especially for foreign buyers. Dubai allows non-residents and expatriates to purchase property in designated freehold areas. Freehold ownership means the buyer owns the property outright and can sell, lease, or pass it on without restrictions.

Foreign buyers can purchase property as individuals or through a company structure, depending on investment strategy and asset planning. Individual ownership is the most common and straightforward option, while company ownership may suit larger portfolios or specific structuring needs.

Key ownership concepts to understand include:

- freehold vs leasehold property

- individual vs corporate ownership

- title deed as proof of ownership

- inheritance and long-term ownership rights

Understanding ownership rules early ensures legal security and avoids complications later in the process.

Defining your goal before buying a property in Dubai

Every successful Dubai property purchase starts with a clear goal. Buyers who skip this step often choose the wrong property type, location, or strategy. Dubai offers opportunities for income generation, long-term appreciation, and lifestyle use, but each requires a different approach.

Some buyers focus on rental income, prioritizing strong tenant demand and stable yields. Others aim for capital growth, often choosing off-plan projects or emerging areas. Lifestyle buyers may prioritize location, community, and long-term living comfort.

Before proceeding, clarify:

- investment vs end-user purchase

- short-term vs long-term holding

- income-focused vs growth-focused strategy

- risk tolerance and budget limits

A clear goal acts as a filter for every decision that follows.

Setting your budget and understanding the full cost of buying property in Dubai

When buying property in Dubai, the purchase price is only part of the total cost. Buyers should prepare a realistic budget that includes all acquisition and ownership expenses to avoid unpleasant surprises.

One-time costs typically include registration fees, administrative charges, valuation fees, and agency commissions. Ongoing costs may include service charges, maintenance, insurance, and property management, especially for rental properties.

A strong budget plan accounts for:

- total cash required upfront

- net return after all costs

- furnishing expenses if renting

- reserve funds for maintenance

Understanding the full cost structure allows for accurate ROI calculations and smarter decision-making.

Choosing the right property type in Dubai

Dubai offers a wide variety of property types, and selecting the right one is critical to achieving your goals. Apartments are the most popular choice for investors due to liquidity and rental demand, while villas and townhouses attract families and long-term tenants.

Buyers must also decide between residential and commercial property, as well as off-plan and ready units. Each option has different risk profiles, timelines, and return expectations.

Common property choices include:

- apartments for long-term or short-term rental

- villas and townhouses for family tenants

- off-plan properties for appreciation

- ready properties for immediate income

Matching property type to strategy directly impacts performance and exit flexibility.

Selecting the right location when buying property in Dubai

Location is one of the most powerful drivers of rental demand, resale value, and long-term appreciation. In Dubai, infrastructure, connectivity, and lifestyle amenities strongly influence property performance.

Prime locations offer stability and consistent demand, while emerging areas may provide higher growth potential at lower entry prices. Tourist-focused districts suit short-term rentals, while residential communities favor long-term leasing.

Key location factors include:

- proximity to business hubs and transport

- tenant profile and demand strength

- future development plans

- resale liquidity

A strong location strategy reduces vacancy risk and protects long-term value.

Deciding between off-plan and ready property in Dubai

One of the most important decisions when buying property in Dubai is choosing between off-plan and ready units. Off-plan properties are purchased before completion and often come with lower prices and flexible payment plans.

Ready properties, on the other hand, are completed and can generate rental income immediately. They offer greater certainty but usually require higher upfront capital.

The choice depends on:

- time horizon

- liquidity needs

- income vs growth priorities

- tolerance for construction timelines

Understanding this distinction helps buyers align expectations with outcomes.

Conducting due diligence before buying property in Dubai

Due diligence protects buyers from poor decisions and underperforming assets. This step involves evaluating the developer, building quality, service charges, rental demand, and legal documentation.

Many first-time buyers underestimate the impact of service charges and maintenance costs on net returns. Others fail to verify developer track records or realistic rental pricing.

Effective due diligence includes:

- developer and project background checks

- service charge analysis

- rental market comparison

- documentation verification

Thorough analysis separates strong investments from risky ones.

Understanding the legal process of buying property in Dubai

The Dubai property buying process is structured and transparent. Buyers typically sign a reservation agreement, followed by a Sales and Purchase Agreement for off-plan properties or a Memorandum of Understanding for resale transactions.

The transaction is registered with the relevant authority, and ownership is transferred once payments are completed. Buyers can complete the process remotely using Power of Attorney if needed.

Understanding each legal step ensures a smooth and predictable transaction.

Choosing between cash purchase and mortgage financing

Buyers can purchase property in Dubai using cash or mortgage financing. Cash buyers benefit from faster transactions and stronger negotiation power, while financed buyers preserve liquidity.

Mortgage availability depends on residency status, income profile, and bank criteria. Financing impacts ROI, risk exposure, and exit strategy.

Choosing the right payment method depends on financial structure and long-term goals.

Completing the purchase and receiving ownership

Once final payments are made, the property is transferred, and the title deed is issued. For ready properties, buyers should conduct a snagging inspection to identify any defects before handover.

This step confirms legal ownership and allows buyers to move forward with rental or resale plans.

Planning rental strategy and property management

After buying property in Dubai, investors must decide how to generate income. Long-term rentals offer stability, while short-term rentals can deliver higher yields with more active management.

Many foreign buyers choose professional property management to ensure hands-off ownership. Well-managed properties perform better and retain value over time.

Rental planning should include pricing, furnishing, tenant selection, and maintenance.

Understanding taxes and ownership obligations

Dubai offers a highly favorable tax environment for property buyers, with no personal income tax and no capital gains tax. However, owners must still account for service charges and municipality fees.

Understanding ongoing obligations ensures compliance and protects returns.

Residency options linked to buying property in Dubai

Property ownership may support long-term residency options under certain conditions. While residency should not be the sole motivation for buying, it adds lifestyle and planning value.

Planning your exit strategy

Every property purchase should include an exit plan. Dubai offers relatively strong resale liquidity, but timing, location, and market conditions matter.

Planning exit strategies early improves flexibility and protects capital.

Common mistakes to avoid when buying property in Dubai

Common mistakes include buying without a strategy, ignoring service charges, choosing weak locations, and relying on unrealistic rental projections. Education and planning prevent costly errors.

Summary

Buying property in Dubai step by step is a structured and transparent process when approached with the right preparation. From understanding ownership rules to selecting the right property, location, and strategy, success depends on planning, due diligence, and realistic expectations. With the right execution, Dubai property can deliver strong income, long-term growth, and strategic value for both investors and end-users.

- Affordable Communities to Buy Properties in Dubai

- Dubai real estate vs global markets in 2026: where does ROI perform better?