Fugitive crypto scammer Daren Li associated with Dubai villa that earns $68,000 in yearly rental income.

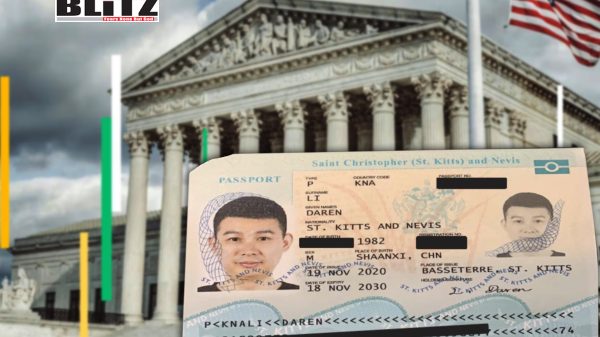

Daren Li, a fugitive cryptocurrency scammer, has been linked to a prime property in Dubai that generates significant rental income. This five-bedroom villa, located in the upscale Wadi Al Safa 7 area, has been reportedly earning around AED 250,000 (approximately $68,000) annually. Li, who is of Chinese origin and also holds citizenship in Saint Kitts and Nevis, is under scrutiny for his involvement in a massive fraud scheme targeting U.S. citizens.

Legal Troubles for Daren Li

Recently sentenced to 20 years in federal prison by a U.S. court for orchestrating a Cambodia-based cryptocurrency investment scam, Li is believed to have laundered upwards of $73 million. Despite being declared a fugitive, the Dubai property remains under active lease agreements. The last recorded tenancy agreement extends through September 2025, indicating that the villa’s rental operations are well-managed. Li utilized his Saint Kitts passport when acquiring this property, which speaks volumes about the complexities of international citizenship and financial dealings.

The Rental Market in Dubai

Li’s villa is set in a gated community, making it appealing to expatriates looking for discretion and security. The Dubai real estate market has always attracted investors for its favorable tax environment and high rental yields. Foreign nationals are allowed to own property in designated areas, adding to the allure. The sustained income from the villa suggests that it is viewed as an asset that contributes significantly to Li’s financial portfolio, even amid his legal challenges.

Prosecutorial Efforts and Li’s Arrest

The U.S. District Court for the Central District of California ordered Li’s 20-year sentence after he pled guilty in a conspiracy to commit money laundering. However, events took an unexpected turn when he allegedly removed an electronic monitoring device and vanished before his prison term commenced. U.S. authorities have described Li’s operation as a sophisticated fraudulent scheme that targeted American investors, luring them with false promises of high returns on seemingly legitimate cryptocurrency platforms.

Notably, Li’s case is emblematic of broader issues regarding asset tracing in cross-border financial crimes. The U.S. Attorney’s Office asserts that Li and his associates ran a complex online fraud network featuring fake domains and fraudulent websites designed to mimic real cryptocurrency exchanges. Victims were deceived into depositing their money into these non-existent platforms, leading to significant financial losses for many.

Complexities of Asset Recovery

As authorities work to track down Li and enforce his lengthy prison sentence, questions about the future of his Dubai villa loom large. Despite ongoing investigations into the legality of his assets, the complexities of international law complicate matters. U.S. law allows for the forfeiture of assets connected to criminal activities, but executing such actions overseas typically requires extensive legal cooperation between countries. Li’s fugitive status adds another hurdle, as judicial processes can be even more intricate when a defendant is not physically present.

The broader implications of Li’s case extend to how cryptocurrency fraud and global real estate investments intertwine, raising scrutiny over the use of real estate as a means of laundering illicit funds. For victims of the alleged scam, recouping lost investments may hinge on identifying and freezing assets tied to the crime, including Li’s Dubai property. As investigations continue, the intersection of digital finance, regulatory environments, and international cooperation in asset recovery remains a pressing issue.