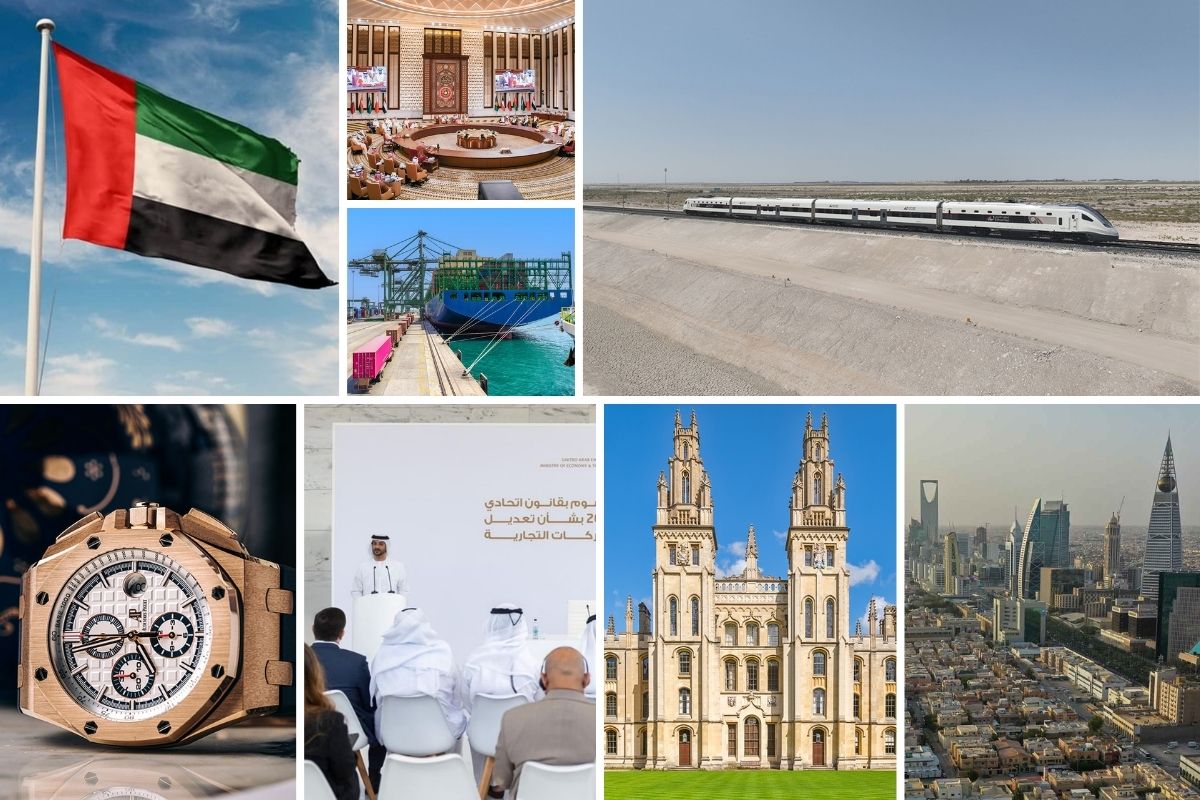

UAE rail updates, Saudi market growth, and Dubai real estate trends: Top 10 highlights.

Recent developments in the UAE and Saudi Arabia illustrate a strong momentum in sectors like rail, real estate, capital markets, and corporate governance. Exclusive interviews and insightful reports are providing a deeper understanding of evolving investment patterns, encompassing areas from luxury watches to real estate and port development.

UAE’s Etihad Rail Project: Connecting the Emirates

Etihad Rail has unveiled comprehensive plans for a national passenger rail network in the UAE, heralding a significant leap in transport and infrastructure for the country. This project aims to provide the UAE’s first fully integrated passenger rail system, linking 11 cities through strategically placed stations. The initiative is designed to enhance connectivity among the Emirates, ensuring safe and dependable mobility for citizens, residents, and tourists alike.

In 2025, the first four stations in Abu Dhabi, Dubai, Sharjah, and Fujairah are set to launch, with additional stations in Al Sila’, Al Dhannah, and Al Dhaid to follow in phased operations. This ambitious network not only promises efficient transport but also supports economic growth across multiple sectors, marking a pivotal moment in the country’s infrastructure evolution.

Saudi Global Ports: Expanding to Compete with UAE

In a bid to compete with the UAE’s established dominance in transshipment, Saudi Global Ports is spearheading a $933 million investment to expand its operations over the next five years. This initiative, focusing on container terminals and logistics facilities, signifies a strategic effort to draw gateway cargo that has typically funneled through UAE ports like Jebel Ali.

The CEO of Saudi Global Ports, Rob Harrison, highlighted that this investment represents a shift from merely operating ports to developing a comprehensive logistics ecosystem. This evolution aims to cater directly to the kingdom’s 36 million consumers, positioning Saudi Arabia as a formidable player in the regional logistics landscape.

Saudi Arabia’s Property Market Now Open to Foreign Buyers

Saudi Arabia is preparing to open select areas of its real estate market to foreign investors, largely due to the enactment of a new law that permits non-Saudis to acquire property in designated zones. This development aligns closely with the government’s Vision 2030 economic diversification strategy and is one of the most significant changes in the country’s property sector in decades.

After months of anticipation, the law simplifies previous restrictions on foreign ownership, laying out clearer guidelines for potential investors. The legislation is designed to attract more foreign investments into the Saudi real estate market, enhancing its appeal to international buyers.

Dubai Real Estate Market Thrives Despite Global Challenges

Dubai’s real estate market has demonstrated remarkable resilience and growth amidst global fluctuations, as detailed in the Annual Dubai Property Market Report. The report reveals sustained transactional activity alongside rising prices and rental rates, reflecting ongoing confidence in the sector.

Haider Ali Khan, CEO of Bayut and Dubizzle, noted the market’s stability, driven by consistent demand and new regulatory frameworks. The introduction of innovations such as real estate tokenization signifies an evolving landscape that continues to inspire investor confidence in Dubai’s residential property market.

With robust infrastructure projects and newly implemented laws, both the UAE and Saudi Arabia are shaping a compelling narrative of growth and opportunity, positioning themselves as vital economic hubs in the Gulf region.